Time:2025-11-05 Popularity:219

A general rate increase (GRI) of approximately $800 per FEU implemented by ocean carriers this weekend on the Asia to US West Coast trade is already beginning to erode amid a fundamental lack of demand, forwarders and carriers say.

“The load factor to the West Coast is really not that strong,” Chris Sur, executive director for global sales at logistics provider Glovis America, told the Journal of Commerce.

The GRI, enacted on Saturday, showed some initial staying power, coming just days after the US and China reached a broad trade deal that partially rolled back some tariffs and set a one-year pause on reciprocal port fees. A carrier executive said that in the immediate aftermath of the agreement, some retailers wanted to begin pulling fresh cargo into the US quickly because of uncertainty over how long the truce would last.

That strategy lent support to rates on the West Coast trade, and the new GRI.

“There was a bit of pent-up demand, and the West Coast is the fastest route,” the carrier executive said.

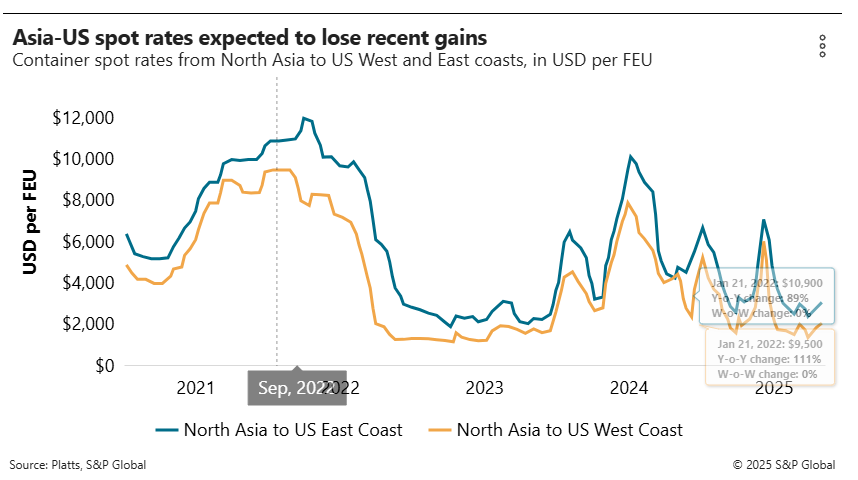

The GRI pushed the West Coast spot rate up to about $2,750 to $2,850 per FEU; the rate one week earlier was about $2,040 per FEU, according to Platts, a sister product of the Journal of Commerce within S&P Global.

But the bullishness was short-lived, with sources saying the market had already begun to give up the GRI gains by Tuesday.

The rate moves for Asia to East Coast business were even more dramatic.

Trans-Pacific carriers over the weekend attempted to impose a $1,000 per FEU GRI on shipments from Asia to the East Coast, but that GRI “completely collapsed,” a forwarder said. By Monday, the East Coast spot rate had dropped to about $2,750 to $2,850 per FEU — about the same level as the West Coast rate, a mark of parity that is highly unusual.

“I never remember that happening before,” the forwarder said.

Sur said the reality in the eastbound trans-Pacific is that retailers have already imported their holiday season merchandise for the Black Friday sales that begin on the day after Thanksgiving in the US. The remaining two months of the year will be a weak period for imports, as they usually are, he said.

Meanwhile, bookings for shipments from China into the US fell about 16% in October compared with September, according to data from maritime visibility provider Vizion and data and analytics company Dun & Bradstreet. Still, bookings for Chinese cargo during the second half of October rebounded somewhat, increasing by more than 15% compared with the first half of the month.

The structural weakness in overall demand in the eastbound trans-Pacific will likely continue through the end of the year, but that does not preclude carriers from attempting to implement further GRIs, Sur said.

“If carriers have the resolve to do it, they’ll do it,” he said.