Time:2025-11-05 Popularity:204

The year-long pause on US port fees for Chinese-operated or -built ships, agreed to last week between US and Chinese officials, will start on Nov. 10, the White House announced Saturday.

The move will pave the way for China to lift its retaliatory port fees on US-owned and -controlled vessels, although there was no immediate response from Beijing whether its suspension of port charges will occur on the same day as the US action.

But one Hong Kong-based analyst expected China to end its charges on Nov. 10 or shortly after, repeating what happened when China followed the US in imposing reciprocal port call charges on Oct. 14.

During the 12-month pause in port fees, “the US will negotiate with China” over Beijing’s alleged dominance in the maritime, logistics and shipbuilding sectors, the White House statement said, without giving further details. Those talks would take place while the US continued “its historic cooperation with the Republic of Korea and Japan on revitalizing American shipbuilding,” the statement added.

The Nov. 10 date was announced in a statement that also gave further details of the trade concessions agreed to by both sides during talks in Kuala Lumpur, Malaysia, on Oct. 26 and confirmed by presidents Donald Trump and Xi Jinping at their meeting in South Korea last Thursday.

The broad agreement will see China purchase at least 12 million metric tons of US soybeans during the last two months of this year and buy at least 25 million metric tons a year in 2026, 2027 and 2028. Additionally, China will resume purchases of US sorghum and hardwood logs.

China will also suspend all the retaliatory tariffs announced since March 4, including levies “on a vast swath of US agricultural products including chicken, wheat, corn, cotton, sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables and dairy products,” the White House statement said. China will suspend or remove all retaliatory non-tariff countermeasures taken against the US since March, the statement added.

“China will further extend the expiration of its market-based tariff exclusion process for imports from the United States and exclusions will remain valid until Dec. 31, 2026,” the White House said. “China will terminate its various investigations targeting US companies in the semiconductor supply chain, including its antitrust, anti-monopoly, and anti-dumping investigations."

The White House did not give any timeframe for China’s implementation of the trade concessions.

For its part, the US will end the 10% so-called “fentanyl tariffs” on Nov. 10 and maintain its suspension of heightened reciprocal tariffs on Chinese imports until Nov. 10, 2026. The current 10% reciprocal tariff will remain in effect during the suspension period, the statement said.

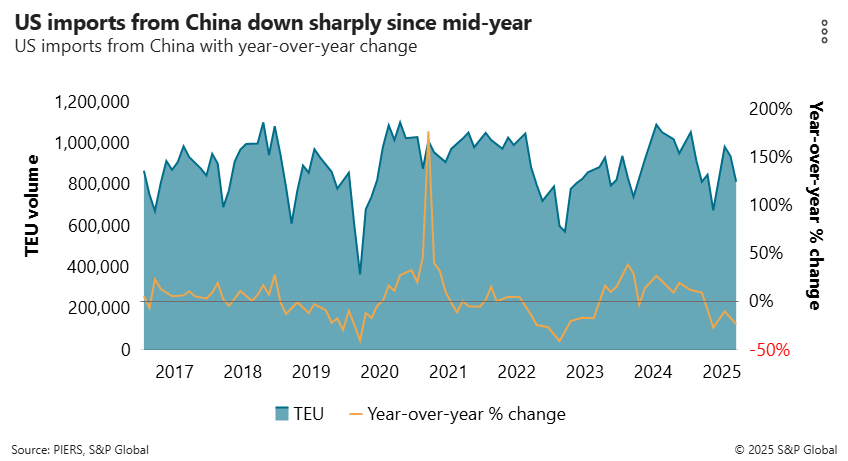

US imports from China have fallen sharply since mid-year amid the trade dispute. Imports hit 984,280 TEUs in July, the second-highest mark in 2025, then fell in August and September, according to PIERS, a sister product of the Journal of Commerce within S&P Global.

Despite the US-China deal on port fees, Brian Maloney, a partner at New York-based law firm Seward & Kissel’s maritime and transportation group, said there are still many questions to be answered.

“Will this apply to foreign-built vehicle carriers and ro/ro vessels or will the pause apply only to the fees for Chinese-owned, -operated or -built vessels?,” Maloney said. “When will the Chinese response pause kick in, which could matter for vessels actively trading? And will either country extend retroactive relief to Oct. 14?”

Lars Jensen, CEO of consultant Vespucci Maritime and a Journal of Commerce contributor, said the lower tariffs open a window of opportunity for US shippers.

“The question is whether it will prompt a boost in shipments — effectively pulling the seasonal boost from Chinese New Year forward by more than a month,” Jensen said in a LinkedIn post Monday. “The coming weeks will show whether this is going to happen, or whether US importers see the upside of lower tariffs more than counteracted by a risk of consumer spending slowdown in the US.”

Jensen pointed out that shippers will have to go through the details of how the deal impacts them specifically.

“But it is important to note here that almost all US actions are temporary in the sense that actions are merely paused until Nov. 10, 2026,” he wrote. “This means that more trade talks will have to happen prior to that date, and with this comes the risk of more changes [positive or negative]."