Time:2025-04-18 Popularity:358

The 90-day pause in US tariffs on its non-China trading partners is not yet causing a significant increase in frontloading on the trans-Atlantic, but there are signs of rising demand on the westbound trade lane.

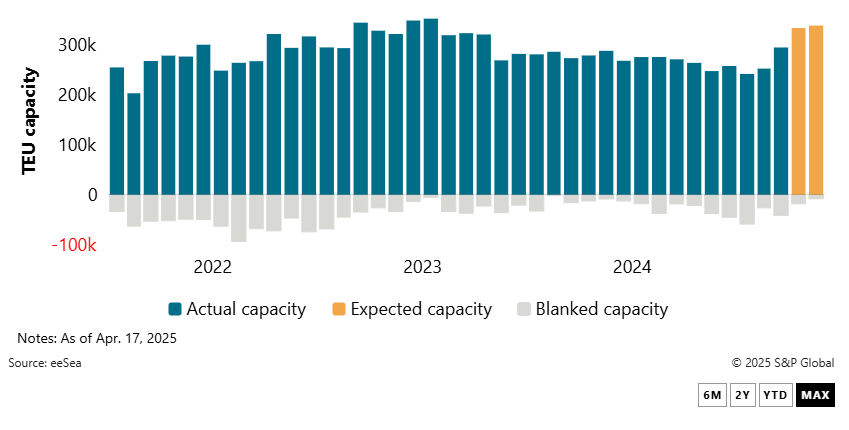

For a start, there have been limited blank sailings announced on the trans-Atlantic in the coming weeks, with just 7,124 TEUs to be withdrawn from North Europe to the US East and Gulf coasts in May, according to ocean visibility provider eeSea.

“It seems as if carriers are pushing up capacity to cater for whatever frontloading may be needed by European exporters,” Peter Sand, chief analyst at rate benchmarking platform Xeneta, told the Journal of Commerce.

“By reducing the number of blank sailings, the offered capacity is close to an all-time high, which is indicative of fairly strong demand right now as spot rates go up,” Sand added. “The 90-day pause in tariffs-on/tariffs-off is seen by some shippers as an opportunity to fill inventories while hoping for a more permanent situation without flip-flopping political proposals.”

Data from eeSea shows capacity of 340,616 TEUs will be deployed in May on the westbound trans-Atlantic, a 1.4% increase compared with April. But the blanked capacity in May is significantly less than the 17,256 TEUs withdrawn in April

Container ship capacity deployed from Northern Europe to US East and Gulf Coasts, with historical blanked capacity, capacity estimates and blank sailings already announced.

Another potential sign of shippers advancing orders is an increase in rates. After months of decline, the spot market on the North Europe-US East Coast trade is up almost 4% since late March, reversing the downward trend following the brief strike at ports along the East and Gulf coasts last October. Spot rates are currently at $2,162 per FEU, according to Xeneta.

The third sign of an expected surge in trans-Atlantic demand comes from the peak season surcharges (PSS) being levied by some carriers. Mediterranean Shipping Co., one of the most active carriers on the trade lane, has announced a $1,000-per-FEU PSS to take effect on May 13 from North Europe to the US, Canada and Mexico.

Peak season surcharges are also planned for the Mediterranean to North America trade lane from May 3. Hapag-Lloyd will add $750/FEU, while MSC and CMA CGM will implement a $1,000/FEU PSS.

On March 12, the US applied a 25% tariff to iron, steel, aluminum and derived products from around the world. On April 3, that was extended to include cars and car parts, also at 25%, with an additional 20% increase on goods originating from the European Union.

Then on April 9, the Trump administration announced a 90-day temporary pause for countries open to negotiations, leaving the 10% across-the-board baseline tariff on Europe in place during the negotiating period.

The European Union has also suspended its reciprocal tariffs on US exports such as Harley-Davidson motorcycles, bourbon whiskey and boats. A second phase of tariffs due to take effect April 15 has also been suspended for the 90-day period. Those target industrial and agricultural products from the US, including steel and aluminum, textiles, leather goods, household appliances, tools, plastics, wood products and foodstuffs such as poultry, beef, seafood, nuts, dairy, sugar and vegetables.

With the 90-day window open to shippers, Europe’s port of Antwerp-Bruges is watching closely for changes in trade flows with the US, the Belgian hub’s second-largest trading partner.

In 2024, exports to the US totaled 613,437 TEUs, consisting mainly of auto and machinery parts from Germany, chemicals, vehicles, food, plastics and pharmaceuticals. Imports from the US included plastics, polymers, chemicals, rubber, vehicles, food and pharmaceuticals.

“So far, there have been no significant traffic shifts directly linked to the recent measures,” the port of Antwerp-Bruges said in a statement Wednesday. “While some companies are acting in anticipation, a marked increase in exports to the US has not materialized.”

While the direct impact of US tariffs was limited “for now,” Antwerp-Bruges warned that could change quickly amid geopolitical tensions and further development in trade tariffs.

Meanwhile, Maersk has issued a customer advisory warning of increasing congestion levels and operational disruptions at several ports across Northern Europe, specifically Antwerp and Bremerhaven, adding delays to ships on both Asia-Europe and trans-Atlantic trades.

“This is a result of multiple factors affecting the ports, such as strike actions, phase-in and phase-out plans of ocean networks across the industry, low water levels on continental hinterland arteries and the lower than usual labor availability ahead of the Easter holidays,” the carrier advised.

“The combination of these factors is leading to additional yard density and increased container dwelling above the ports’ operational capacity,” Maersk added.