Time:2025-09-18 Popularity:293

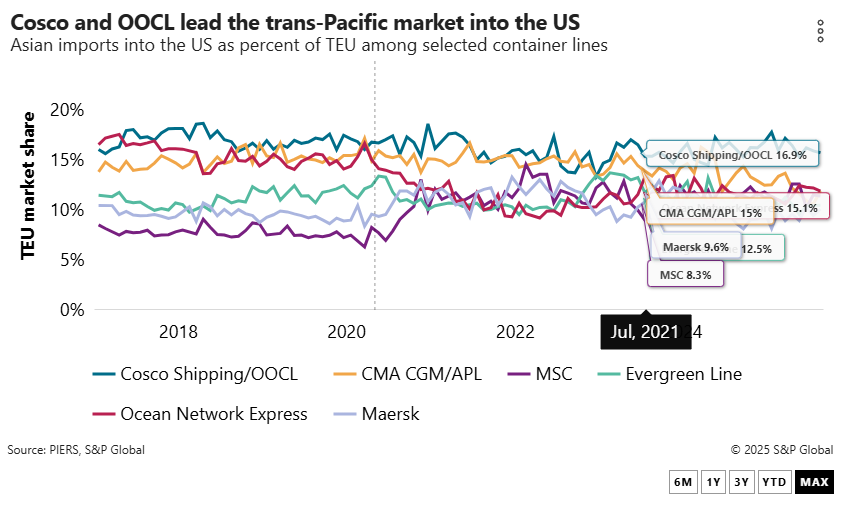

Cosco Shipping has informed its US customers to expect little change in its services and rates as the carrier starts paying new service fees for US port calls in October, becoming the latest container line to signal it will absorb the Trump administration’s penalties against China’s maritime industry.

Cosco said in a customer advisory Wednesday it will “continue to serve the US market” once the US Trade Representative (USTR) begins collecting fees on Chinese-built and -operated ships calling US ports starting Oct. 14. The fees stem from the USTR’s findingthat China has used unfair trade practices to promote its shipbuilders and ocean carriers.

While the new fees “may pose certain operational challenges,” Cosco said it does not plan to remove any trans-Pacific services, reduce its US ship deployment, or impose new surcharges to cover the fees.

“We are committed to maintaining stable capacity deployment and service quality,” Cosco said. “We will maintain competitive rates and surcharges.”

Cosco’s advisory follows similar announcements from competitors CMA CGM and Mediterranean Shipping Co.(MSC), which have both said they hope to mitigate the impact of the fees after having rotated most, if not all, of their China-built container ships out of US services prior to mid-October.

As a China-based carrier, Cosco does not have that option under the USTR’s action, which assesses a higher penalty for Chinese carriers than for Chinese ships. Cosco, along with its OOCL subsidiary, face a $50 per net ton fee for any of their vessels on their first port call to the US, up to five times per year. The fee rises to $140 by 2028.

In contrast, a Chinese-built ship operated by a non-China domiciled carrier only faces an $18 per net ton fee in the first year of the USTR’s penalty scheme, rising to $33 by 2028.

Investment bank HSBC estimated that a Chinese-operated ship of 10,000-TEU capacity would pay $2.7 million for its first US port call in the first year of the new fees, equating to a roughly $600 per container fee. A Chinese-built ship of similar size faces a $1 million fee, or roughly $222 per container.

Based on the number of US calls per year, HSBC estimated Cosco could pay $1.5 billion in USTR fees through 2026.

The question then becomes whether the Chinese government will offset those new port fees through subsidies. The USTR investigation cited estimates that China provided some $3.4 billion in subsidies between 2010 and 2018 to the country’s major carriers and port operators.

Cosco’s last annual report listed $169 million in subsidies received during 2024, down from $423 million in 2023. Those subsidies, though, do not extend to OOCL, which itself could face $654 million in port fees, HSBC estimated.