Time:2025-09-11 Popularity:332

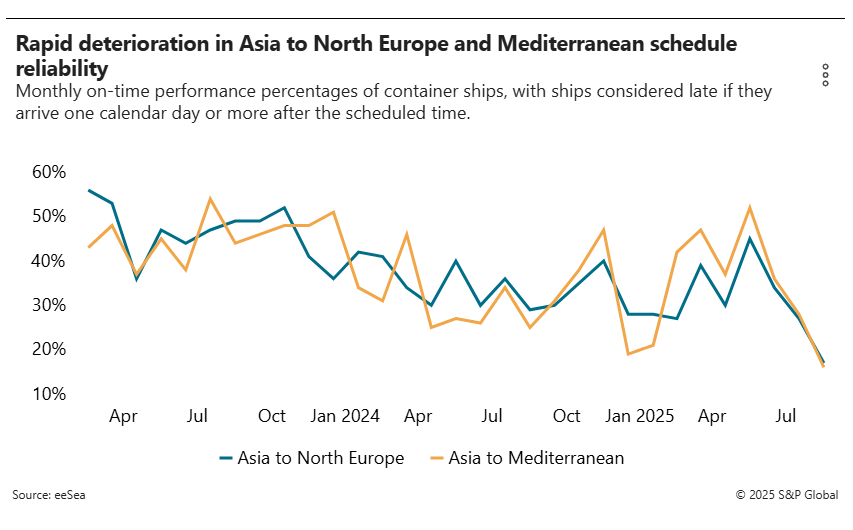

Asia-Europe ocean carriers face a moving target in their attempts to match rising capacity with softening demand due to a slew of new vessels entering the trade lane and ongoing port congestion dragging schedule reliability to dismal levels.

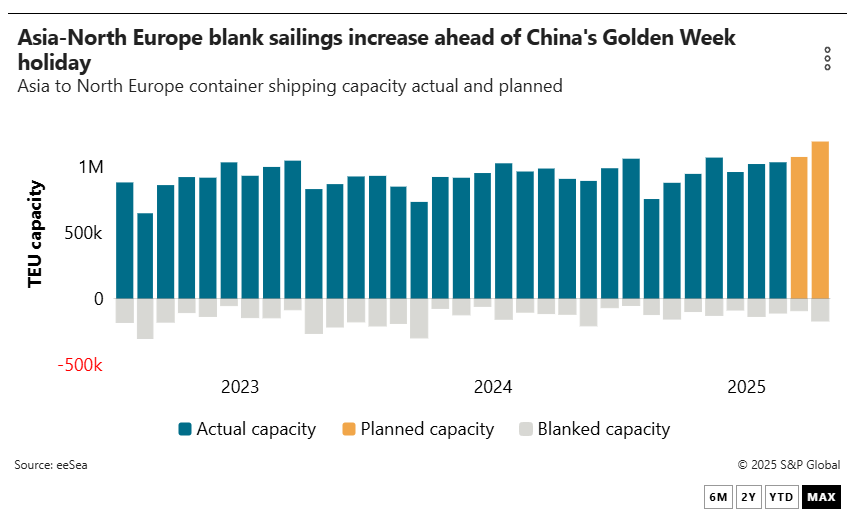

Despite reports of full ships from carriers, the frontloading that led to an early peak season on the Asia-Europe trade is expected to curb demand through the last quarter, with blank sailings announcements picking up ahead of China’s National Day Golden Week holiday that begins on Oct. 1.

“The Asia-Europe trade lane saw peak season earlier this year, with the usual September surge already past,” C.H. Robinson noted in a September market update. “This shift in timing patterns means that September through December will likely see below-normal shipping volumes compared to historical trends.”

The weakening volume will coincide with the delivery of more than 1 million TEUs in capacity that are scheduled to enter service before the end of the year. Importantly, 67% of the new vessels will have a capacity of more than 15,200 TEUs, according to Alphaliner, which means most will necessarily be deployed on the already oversupplied Asia-North Europe and Mediterranean trades.

Alan Murphy, CEO of Sea-Intelligence Maritime Analysis, noted in the firm’s Sunday Spotlight newsletter that Asia-North Europe rates are showing structural weakness.

“This could imply an increasing overcapacity of ultra-large container vessels, which to a large degree have no other relevant deployment focus than the Asia-Europe trade,” he explained. “As such, this is problematic going forward, as we will see ever more of these vessels delivered.”

The carriers, for their part, are managing capacity by blanking sailings, but not at the same level as last year, said Destine Ozuygur, product marketing manager at rate benchmarking platform Xeneta.

“We saw blanking announcements from Mediterranean Shipping Co. (MSC) last week and a few more, which we are currently factoring into the database,” she told the Journal of Commerce.

MSC announced six blank sailings on Asia-Europe loops for the last two weeks of September, ahead of China’s National Day Golden Week holiday, while Maersk has said it will blank four sailings in late September and early October.

Ozuygur said, so far, carriers are scheduled to blank a total of 13 Asia-North Europe sailings in September and 16 in October, far short of the 25 sailings canceled in September and 39 in October last year.

“We do expect to see a few more but don’t currently believe it will reach those [prior-year] levels,” she said.

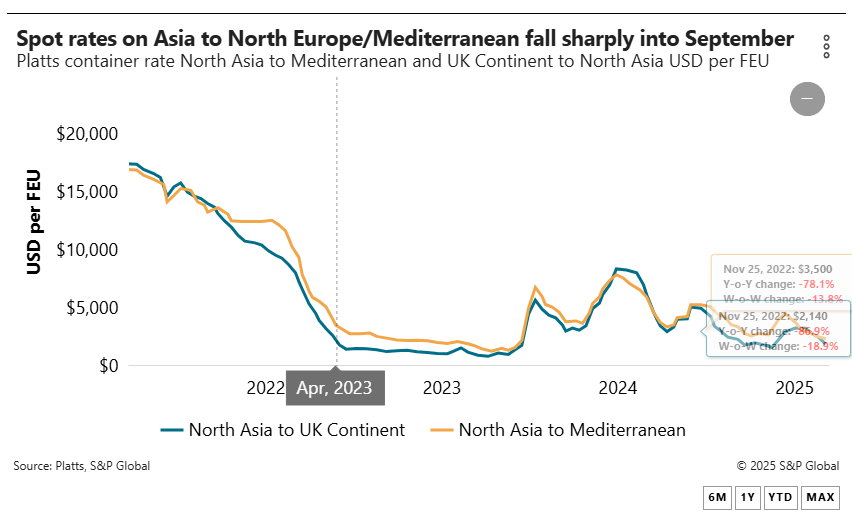

That relative lack of blanks has put additional downward pressure on spot rates, which have been in freefall since mid-July, as reflected by the various rate indices — Drewry’s World Container Index, Xeneta, the Shanghai Containerized Freight Index and Platts.

Average spot rates from Asia to North Europe fell to $1,700 per FEU as of Monday, down 49.1% from the week of July 18 and 63.5% from the same week last year, according to Platts, a sister company of the Journal of Commerce within S&P Global. Short-term Asia-Mediterranean pricing of $2,100 per FEU was down 52.3% from its summer peak in the week of June 20 and 54.7% year over year.

C.H. Robinson wrote in its September update that there is insufficient cargo demand on Asia-Europe to support any rate hikes, with carriers choosing market share over pushing through increases. That could be a positive for shippers beyond the initial cost savings.

“We’re seeing Asia-North Europe spot rates falling at an accelerated pace, while Mediterranean rates are declining more slowly, eliminating the traditional price differential between these destinations,” the forwarder noted.

“This convergence means there’s no longer a significant advantage between North European and Mediterranean discharge ports based solely on rates,” C.H. Robinson added. “Greater flexibility in port selection then allows for more strategic supply-chain optimization beyond the cost of the ocean shipping itself.”

In tandem with the rate decline is schedule reliability that in August fell to its lowest level in years. Data from eeSea shows on-time performance on Asia-North Europe of just 17% and 16% from Asia to the Mediterranean.