Time:2023-05-05 Popularity:814

Across the physical economy, executives and analysts are projecting that the second half of 2023 will bring a rebound. That includes containerized U.S. import volumes, which sees its peak season in late summer to autumn. Some believe U.S. import demand has hit the bottom.

However, further downside risks have emerged for the U.S. economy. It’s wrecking the odds of a second-half rebound in import volumes.

Last June, SONAR’s ocean container bookings data revealed that U.S. import demand for containerized goods was dropping off a cliff, just a few months after FreightWaves’ U.S. truckload data first signaled that a freight recession was imminent. Now, the freight recession of 2023 has officially arrived.

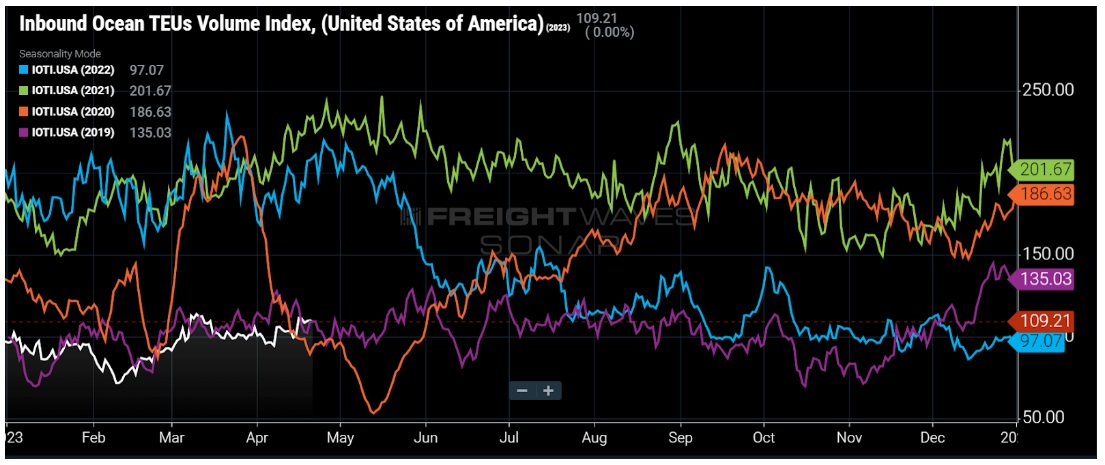

The latest ocean container bookings data from SONAR in the chart above reveals that U.S. containerized import volumes in 2023 (white line) have been trending alongside 2019 levels, which was the last freight recession. This is largely no surprise given this same SONAR data had been projecting this full-on reversion back to pre-pandemic levels for months, but it would also be wise to exhibit caution in assuming these import volumes have already bottomed for this downcycle and are positioned for a second-half rebound during peak season.

As we can see above, in 2019, import volumes followed a very irregular pattern in the second half of the year. There was no clear rebound in volumes during the traditional peak season months that year.

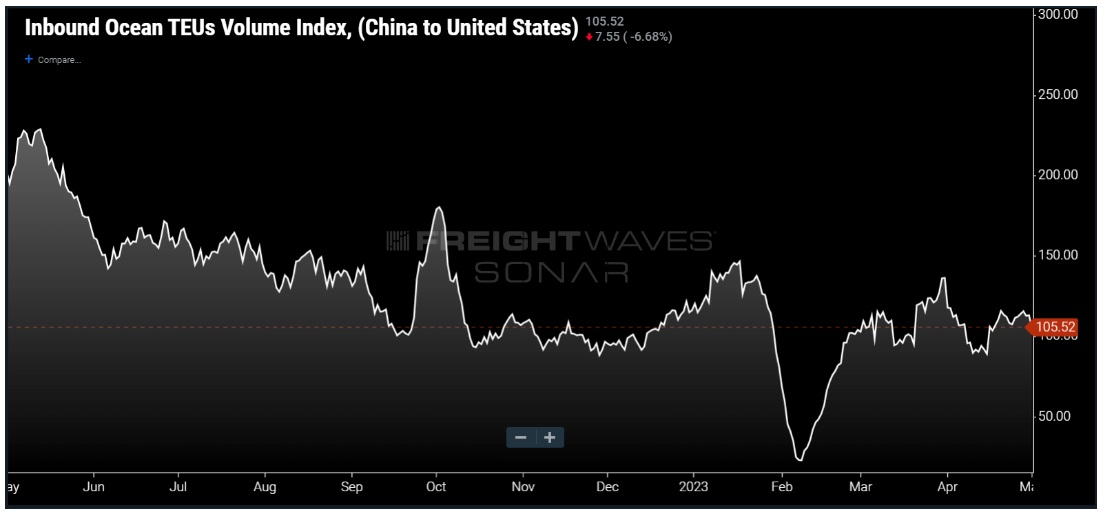

The latest ocean container bookings data for U.S.-bound container volumes departing China again highlights the continued weakness in U.S. import demand that is exhibiting no clear signs of a rebound. This weakness in container volumes is confirmed by the latest contraction in April of Chinese manufacturing data. According to the National Bureau of Statistics, the official manufacturing Purchasing Managers’ Index (PMI) declined to 49.2 from 51.9 in March — and below the midway point of 50 that delineates expansion and contraction.

Hopes that there was a significant amount of pent-up demand caused by the stringent COVID-lockdown measures of 2022 and that a China reopening would cause a surge in container volumes are fading. Without a rebound in the manufacturing sector of the United States’ largest trading partner for containerized ocean imports, a second half-rebound in U.S. import volumes seems even more improbable.

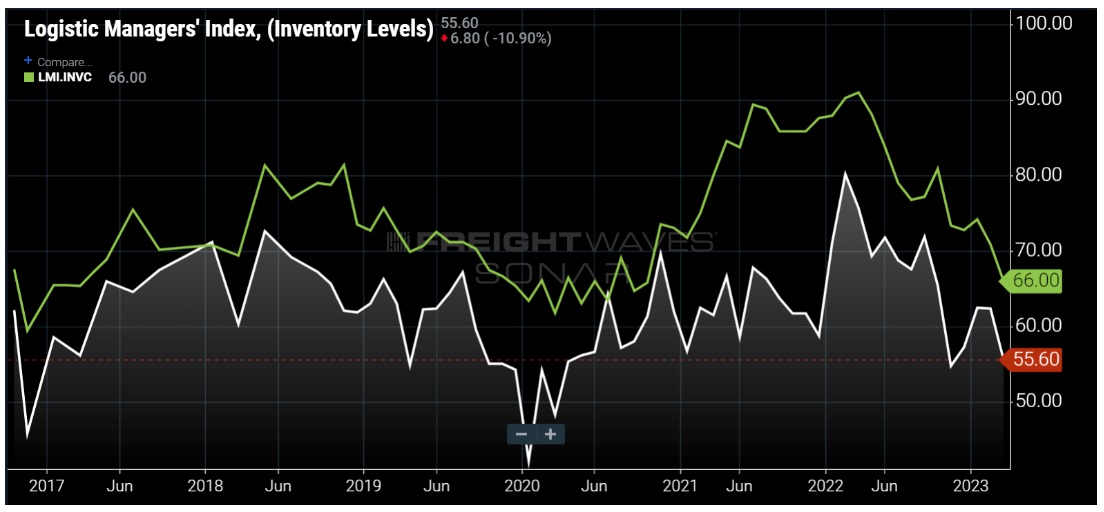

At the turn of the new year, the inventory glut carried over from 2022 by U.S. importers was one of the primary headwinds against import demand. It appeared likely that in the first six months of 2023 that these importers would be able to burn through these excess inventories, enabling them to begin a typical seasonal replenishment cycle that would boost second-half volumes in time for peak season. However, the latest inventory data from the Logistics Managers’ Index (LMI) in the chart above shows both inventory levels (white) and inventory costs (green) still registering above 50 — and still in expansion.

The continued difficulty U.S. importers are having in burning through excess inventories is being exacerbated by weakening consumer demand, which the latest credit card data from the Bank of America (BOA) reveals may already be happening. In its latest report, BOA wrote: “Card spending per Household fell sharply by 1.5% month-over-month (m/m) in March on a seasonally-adjusted (SA) basis. We forecast a below-consensus 1.0% m/m decline in the Census Bureau’s retail sales ex autos figure for March.”

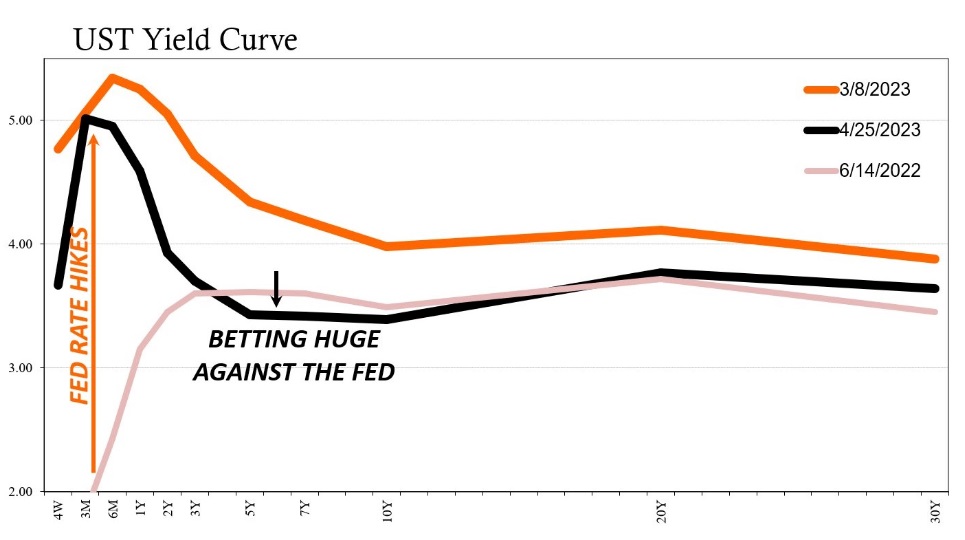

In examining the U.S. Treasury Yield Curve in the chart above, we can see that the markets are placing huge bets that, regardless of what happens in May, not only is it likely to be the end of the hiking cycle but that it is also likely that there will actually be multiple rate cuts in the second half of this year. So, the markets seem to be increasingly convinced that the worsening economic conditions in the coming months will force the data-dependent Fed’s hand into a full pivot. Interestingly, in all major U.S. economic downturns in the 21st century, it was only after the Fed started to actually cut interest rates that the equities market officially hit the bottom.

Given the mounting economic headwinds facing U.S. import demand for the remainder of 2023, a second-half rebound not only seems increasingly unlikely, but we could see U.S. import demand further deteriorate. The industry should be prepared for the growing likelihood of U.S. import demand potentially declining further in the back half of the year. That’s a spooky sign for the economy at large.

Source from freightwaves/ Writer: Henry Byers