Time:2025-12-29 Popularity:148

US importers who will ink annual Asia-US service contracts in the new year are confident enough of their market power in the weakening trade that rates could take a back seat to service-related issues in their coming negotiations with ocean carriers, sources say.

Widening global overcapacity and import volume forecasts warning of weak volume growth will embolden cargo owners to attempt to secure more favorable fine print in their 2026–27 contracts on key service issues such as schedule reliability and flexibility in handling contracted allocations, according to sources.

For most beneficial cargo owners (BCOs), addressing nettlesome service issues, some of which have been around for years, will be the main focus of BCOs when contract negotiations kick into high gear this spring, said David Bennett, an industry adviser who has dealt with service issues as both a carrier and forwarder executive.

“That’s where the conversation needs to go,” Bennett told the Journal of Commerce.

Most service contracts in the largest US trade lane generally run from May 1 through April 30 of the following year. The largest retailers who are able to negotiate the lowest contract rates due to their large volumes normally set the pricing floor for midsize retailers and other importers. The big-box retailers usually wrap up their agreements in January and February. Midsize and smaller importers do most of their bargaining after the annual Journal of Commerce TPM Conference in early March in Long Beach.

Importers, consultants and forwarders say that with low single-digit growth in container volumes projected in 2026, this will be the year to fine-tune service-related clauses in their contracts, especially those issues that can have a monetary impact.

Chief among these is the minimum quantity commitment (MQC) that importers agree to for the life of the contract. The higher the MQC, the lower the fixed rate. Most carriers calculate the fixed rate by taking the total MQC and dividing it by 52. That means the importer is expected to meet its allocation each week, whether it’s at the height of the peak shipping season each fall or during slack seasons such as during the Lunar New Year or post-peak season months.

Industry consultant Bob Fredman, who formerly negotiated service contracts for big-box retailers, said he had a clause in his contracts that allowed the importer to exceed the MQC in peak weeks by 20% and still retain the lower fixed rate on those containers.

A carrier executive source explained that the MQC mechanism is a tool that carriers use to manage their capacity during peak periods and limit their exposure to unused capacity when the market heads south. He agreed, though, that some retailers have had agreements with their regular customers for years that allow them to exceed their weekly allocation by 10% to 20% during peak periods.

A more recent development that is driven by the migration of sourcing from China to Southeast Asia and the Indian sub-continent due to US tariffs is that some carriers are not providing sufficient capacity from load ports in those regions. The carrier executive said Haiphong, Vietnam, is booming with increased manufacturing, but carrier service levels have not kept up with the growth.

An importer in the automotive sector said he is experiencing that issue.

“As our business continues to grow and we have had to shift production due to the Trump tariffs, our focus is more around [securing sufficient] MQC out of new ports,” the source said. “[So far] we have been able to get space beyond existing contract volumes due to the soft market, but certain ports are tighter than others.”

BCOs in 2026 want greater predictability of capacity deployments from carriers so they will have visibility into their freight spend as they negotiate their service contracts, said James Caradonna, executive vice president at the forwarder Spedag Americas. If market demand drops steeply and carriers increase their blank sailings or suspend vessel strings, Caradonna said his clients may find they are not receiving the allocations at fixed rates that they were guaranteed in their MQC commitments.

“They don’t want to go off-contract to get space,” he said.

If carriers return to the Suez Canal in 2026 as some lines indicate may happen, and the delivery of new container ships from shipyards meets forecasts, spot and freight-all-kinds (FAK) rates charged by forwarders would likely drop below the fixed rates in service contracts given the influx of capacity, a second carrier executive said. BCOs would then look to shift more of their business to the lower FAK rates charged by forwarders, he said.

“Those BCOs who feel 2026 will be a year when supply exceeds demand, they will go where they can save money,” the source said. “It’s the nature of the business.”

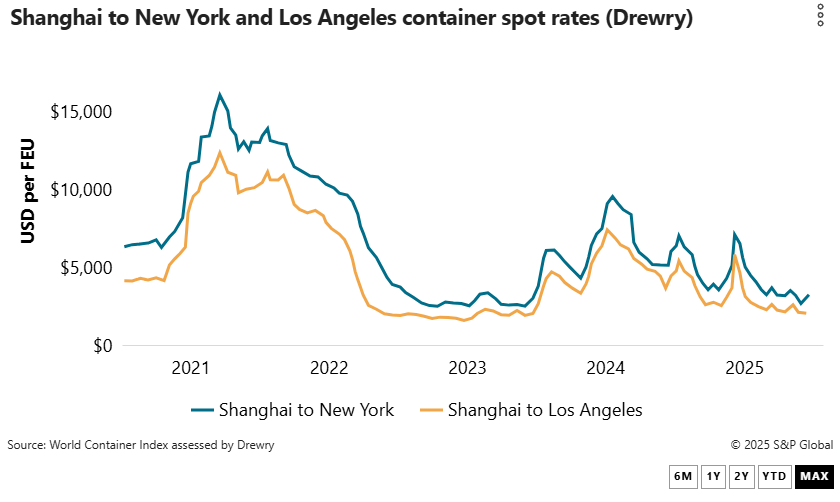

As usual, spot rates that are in effect each spring set the tone for service contract negotiations, and retailers and BCOs anticipate that weak rates will be in place this spring, strengthening their bargaining power.

Industry adviser Kevin Parkerson, who previously negotiated service contracts for large retailers, said he doesn’t expect the market to strengthen much, if at all, during the next three months, which will bolster BCOs’ negotiating position insofar as the fixed rates in their service contracts.

“Retailers are feeling good,” Parkerson said. “Carriers definitely don’t feel too good.”

The spot rate from Asia to the US West Coast as of Dec. 18 was $2,474 per FEU, according to data from Drewry, with the East Coast rate at $3,293 per FEU. In mid-March 2025 with the 2025–26 service contract talks in full steam, rates to the West Coast were $2,906 per FEU, while East Coast rates were at $4,038 per FEU.

Several forwarders and industry analysts said they expect the final service contract rates that will be negotiated this spring will resemble the rates in the current 2025–26 contracts, which for the largest retailers were in the range of $1,500 to $1,600 per FEU to the West Coast and about $1,000 higher to the East Coast. For midsize retailers, the negotiated price to the West Coast was about $1,800 to $1,900 per FEU.