Time:2025-12-22 Popularity:158

Ocean carriers are pushing rate increases and revamping services on Asia-to-Latin American routes amid booming trade, especially between China and Brazil. Trade between China and Mexico, however, faces tariff headwinds beginning in January.

CMA CGM said it would increase rates by $1,000 per container from all Asia ports to the East and West coasts of South America, Mexico and the Caribbean from Jan. 1. The price hike would apply to dry, reefer, paying empties and out-of-gauge cargo, the carrier said in an advisory Thursday.

The move comes about a month after Hapag-Lloyd said it would hike rates by $1,000 per container on the same trades. The carrier’s increase, which took effect from Dec. 1, raised rates for a 20-foot container from Asia to the East Coast of South America (ECSA) from $1,200 to $2,200 and for a 40-foot box from $1,400 to $2,400. Asia-West Coast South America and Asia-West Coast Mexico rates are slightly less, increasing from $1,100 to $2,100 for a 20-foot container and $1,300 to $2,300 for a 40-footer, Hapag said.

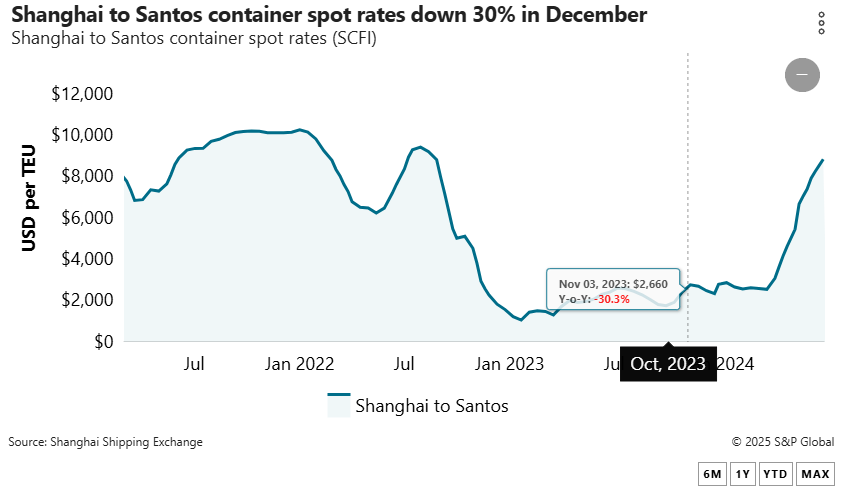

By comparison, rates from Shanghai to Brazil’s Port of Santos were pegged at $1,291 per TEU as of Thursday, according to the Shanghai Shipping Exchange, with rates from Shanghai to Mexico’s Manzanillo at $1,294 per TEU. North Asia-ECSA rates were at $1,525 per FEU as of Wednesday, according to Platts, a sister company of the Journal of Commerce within S&P Global.

“Carriers have been finding it difficult to make rate increases stick,” a senior executive at a Sao Paolo freight forwarder told the Journal of Commerce. “Hapag-Lloyd’s November increase was the second in as many weeks after it announced a $1,000 per container increase from Nov.15.”

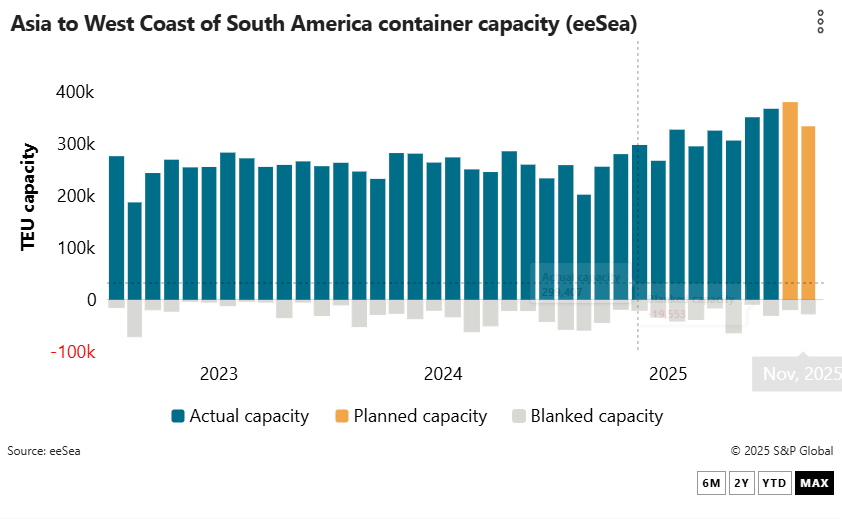

Lackluster rate performance is partly due to the influx of new capacity, which has surged along with trade.

Actual capacity deployed on Asia-WCSA in December is 370,825 TEUs, up from 234,935 TEUs a year ago, according to eeSea data displayed on the Journal of Commerce’s Gateway platform. Similarly, actual capacity on Asia-ECSA services for December rose to 299,490 TEUs, up from 191,429 TEUs in December 2024, the eeSea data showed.

“Our Chinese agents have been warning us that the rates should go up in early January,” Mauricio Fisch, director of Brazil freight forwarder Ocean Express, told the Journal of Commerce.

“The volume of import goods seems to be stable, and I don’t see a big pressure on capacity until the end of the first quarter,” Fisch added.

Highlighting the buoyant trade, official government figures show the value of Brazil’s exports to China increased 34% to $9.2 billion this year through October against $7 million in the same period a year earlier. Imports from China slipped 3% to $6.7 billion in the same period.

“South America’s trade relationships continue to diversify, with China becoming an increasingly important partner,” Ocean Network Express said in a commentary on China-South America trade.

That has prompted carriers to expand their networks in the region.

CMA CGM and Maersk said Friday they would revamp their joint Asia-ECSA (SEAS3/ASAS2) service by adding port calls at Itajai in Brazil and Hong Kong, while dropping Vũng Tàu in Vietnam, starting with the departure of the 6,350-TEU Prestige from Shanghai on Dec. 30.

“Weekly calls in Itajai on top of Santos [will provide the] fastest transit time in the market both [for] imports and exports from central China,” CMA CGM said in an advisory announcing the change. Transit time from Itajai to Singapore is 25 days, with 33 days to Shanghai. The new full rotation is Shanghai, Hong Kong, Shekou, Singapore, Santos, Itajai and Singapore.

CMA CGM is also reshuffling its Asia-West Coast of Mexico and Central America services, adding a call at Ensenada on its Mexico Express M2X service starting Jan. 5, specifically designed for perishable and fresh meat exports from Mexico to Asia.

“M2X will operate once again as a fully dedicated service to Mexico, improving speed, reliability and market relevance,” CMA CGM said in an advisory Friday.

The new rotation is Shekou, Ningbo, Shanghai, Tianjin Xingang, Qingdao, Ensenada, Manzanillo, Lazaro Cardenas and Yokohama. The rotation change means Buenaventura in Colombia has been dropped from the M2X loop but will be restored to the Asia Central South America 1 (ACSA 1) service starting from Pusan on Feb. 23.

The changes reverse alterations CMA CGM made to both services last May.

CMA CGM also announced Friday that Manzanillo would be added to its Pacific East Coast 2 (PEX2) service linking Pusan and China with Latin America and the Caribbean starting from Vũng Tàu on Dec. 27. The carrier said the Manzanillo call will provide a “new solution for [the] Mexico import/export market starting 2026.”

CMA CGM said the changes would also see Singapore dropped from the rotation from Feb. 16 when the full rotation will be Vũng Tàu, Shekou, Hong Kong, Ningbo, Shanghai, Qingdao, Pusan, Manzanillo (Mexico), Balboa, Panama Canal, Manzanillo (Panama), Cartagena, Kingston, Caucedo and Vũng Tàu.

The service shuffles for Mexico come just as the country introduces tariffs of up to 50% on 1,400 products from countries including China, Thailand and Indonesia from Jan. 1. The levies, intended to boost domestic manufacturing, will apply to imports from countries that do not have a free trade agreement with Mexico.

China’s Commerce Ministry said the tariffs will “substantially harm the interests of trading partners, including China.”