Time:2025-12-10 Popularity:156

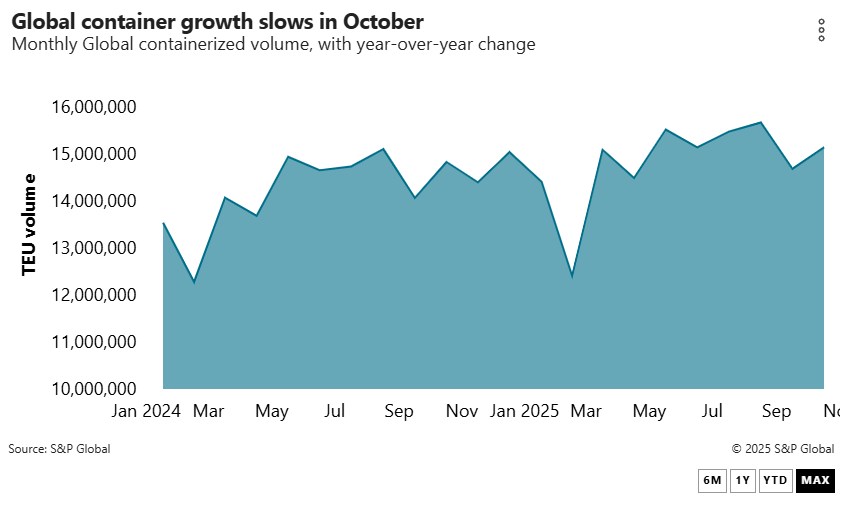

Global container volume growth in October fell to its slowest pace since February as increased trade in Asia, Africa, the Middle East and Latin America was offset by falling US and European imports, according to new data from Container Trades Statistics (CTS).

Global volumes expanded 2.1% year over year in October, with volumes in the first 10 months up 4.4% compared with a year earlier, according to CTS. The softer global growth in October pulled the 12-month rolling average down to the lowest level in 20 months, according to Simon Heaney, senior manager of container research at Drewry.

“Regional container trade growth in 2025 is increasingly asymmetric, with economies commonly grouped — albeit loosely — under the term ‘Global South’ pulling decisively ahead of their ‘Western’ counterparts,” Heaney said.

Import volumes into North America in October fell 6.7% compared with October 2024, while exports from Asia to Europe fell on a year-over-year basis for the first time since February, dropping 3%, according to CTS.

But the plunge in US imports has been the biggest drag on global container volumes. US import volumes are on track to end the year down 1.4% at 25.2 million TEUs, according to the Global Port Tracker released Monday. Moody’s Ratings on Nov. 18 warned that US import volumes in 2026 will be flat to down 2% from this year

Comparably, shipowner association BIMCO forecasts that global container volumes will expand 2.5% to 3.5% next year, while volumes will end this year up 4.5% to 5.5% from 2024.

There have been just two years in which US containerized import volumes have declined to the extent seen in recent months, analyst John McCown said last week on a Journal of Commerce webinar. The most recent was in the spring of 2020 when retailers and other importers slashed orders on fears that retail consumption would plunge in the early days of the pandemic, and the first was 2008–09 in the wake of the financial crisis, McCown said.

“I think we’re looking at perhaps the worst performance year that I can recall, in 2026, in terms of volume growth,” McCown said.