Time:2025-12-02 Popularity:160

Intra-Asia freight rates are expected to continue to climb on increasingly tighter capacity through January due to an extended peak season ahead of the Lunar New Year in mid-February, shipping executives say.

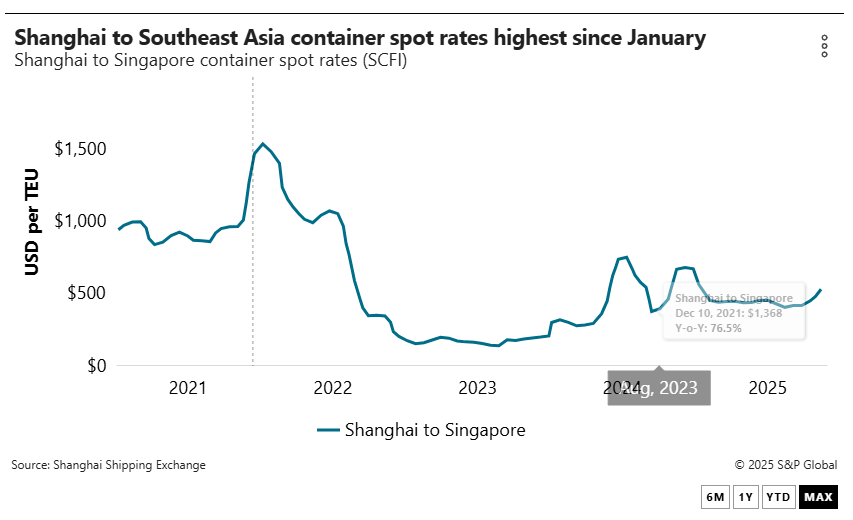

Freight rates on ocean services between China and Southeast Asia are already at multi-month highs following a midyear peak driven by frontloading prior to the implementation of reciprocal tariffs between the US and China, which have since been paused.

“Carriers are announcing general rate increases on a bi-weekly basis and they are always successful,” a spokesperson at FIBS Logistics in Singapore told the Journal of Commerce.

“The GRI quantum is around $50 to $150 per TEU, although it varies for different trades.

“We’re in the peak season now and space is getting tight,” the spokesperson added.

The buoyant freight conditions are expected to continue into January to take into account Lunar New Year, which starts on Feb. 17.

“Normally factories in China close two weeks in advance to allow migrant workers to return home, so January will be the pre-Lunar New Year rush,” the FIBS spokesperson said.

Spot rates from Shanghai to Singapore hit $540 per TEU last Friday, the highest since Jan. 10, according to data from the Shanghai Shipping Exchange (SSE) published on the Journal of Commerce’s Gateway platform.

“During November, rates have known only one direction — up,” said Peter Sand, chief analyst at online rate benchmarking platform Xeneta.

Data from Xeneta mirrored that from the SSE, with rates for a 40-foot container from Shanghai to Singapore climbing to $1,110 on Tuesday, the highest since June 1.

Similarly, rates from Shanghai to Bangkok reached $1,431/FEU on Tuesday, the highest since Aug. 1, while rates from Shanghai to Ho Chi Minh City are now at $1,045/FEU, a level last seen on July 31.

“While you always expect intra-Asia rates to increase in November on account of the region’s peak season, we think this year will be unusual because it will last longer due to next year’s Lunar New Year being later than usual,” a senior executive at a Hong Kong-based freight forwarder told the Journal of Commerce.

“In effect, this year’s pre-Christmas peak will segue into the new year’s pre-Lunar holiday peak,” the executive added.

That comes as recent China customs data has shown an increase in trade between China and Southeast Asia, with northeast Asian countries, including South Korea and Japan, slipping in importance as export destinations.

Customs data shows year-over-year Chinese exports to Southeast Asia’s Association of Southeast Asian Nations (ASEAN) region grew by $61 billion between February and September, while exports to Northeast Asia increased $41 billion. By comparison, exports to the US fell $70 billion in the same eight-month period due to tariff wrangles.

British advisory firm Oxford Economics said the figures showed ASEAN was among the regions that now account for a “steadily rising share of China’s outbound shipments, offsetting softness in developed markets in the US and Northeast Asia.”