Time:2025-11-26 Popularity:202

A shift in the supply-demand imbalance in container shipping dragged down the financial results of ocean carriers in the third quarter, and maritime experts see nothing in market conditions to change their view that the industry’s multi-year profitability voyage will end in 2026.

Global fleet capacity is forecast to grow 6.9% to 32.97 million TEUs this year and by another 2.2% in 2026 to 33.7 million TEUs, according to Drewry Shipping Consultants, and Bimco expects global container volume growth of between 2.5% and 3.5% in both years.

While carriers will remain in the black this year thanks in large part to a strong first half that is already in the bank, full-year operating profit will be near $20 billion for 2025 compared with more than $60 billion last year, Drewry noted. But the maritime consultant is predicting industry losses will top $10 billion in 2026.

The sharp drop in revenue and profits in the third quarter was dramatic across the board. Revenue among the 11 carriers that report their turnover showed a third-quarter drop of $44 billion, down 22% compared with the revenue earned in the third quarter of last year, Sea-Intelligence Maritime Analysis noted in its latest Sunday Spotlight Newsletter.

Despite volume gains across most of the carriers, the combined earnings before interest and taxes (EBIT) in the third quarter fell sharply year over year — from $17.06 billion to $5.12 billion. However, Sea-Intelligence emphasized that although the 2024 peak has passed, the EBIT floor has not yet fallen to pre-COVID 2019 levels.

The analyst said shipping lines also recorded a double-digit year-over-year contraction in average freight rates in the third quarter as the market corrected from the disruption-driven highs of the previous year.

The landing will be particularly hard on the trans-Pacific. After a year of US importers frontloading shipments out of fear of higher tariffs as American consumers become more cautious, replenishment of inventories is being handled judiciously.

US retailers are forecasting double-digit percentage declines in November and December, and monthly volumes are not expected to exceed 2 million TEUs through March, according to the latest Global Port Tracker, produced by Hackett Associates and the National Retail Federation.

Drewry is expecting that the negative growth in Asia-North America volume in the fourth quarter will continue into the first three months of 2026, with zero growth on the trans-Pacific for the full year.

“Our assessment is that the US container boom of 2023 to late 2025 is truly over,” Drewry noted in its Container Forecaster report.

Moody’s Ratings has forecast that US container volumes in 2026 will show growth between 0% to minus 2% year over year.

The grim market outlook was shared by transportation analysts at J.P. Morgan, who noted in a report this week following Zim Integrated Shipping’s third-quarter results that a demand-supply analysis of the trans-Pacific pointed to significant freight rate erosion in 2026 and 2027. Zim is heavily exposed to the trans-Pacific trade lane, where the rate dropped 45% year over year in the third quarter.

“We expect it is unlikely for rates to strengthen structurally into 2026, unless there is material supply that comes out of the market — scrapping and idling remain extremely low — or there is an acceleration in demand, which again appears less likely, given the strength in year-to-date volume growth of 5% year over year,” J.P. Morgan said in its outlook.

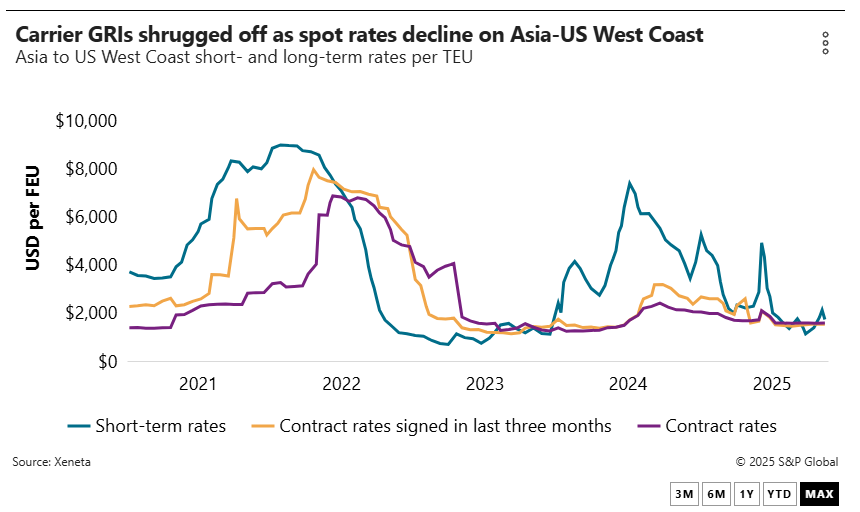

Spot rates from Asia to the US West Coast, as measured by various indexes, are down 30% to 60% year over year, depending on the index and trade lane. Data from rate benchmarking platform Xeneta shows that average short-term rates on the Asia-US West Coast lane of $1,482 per FEU as of Tuesday are down 70% since the first week of July.

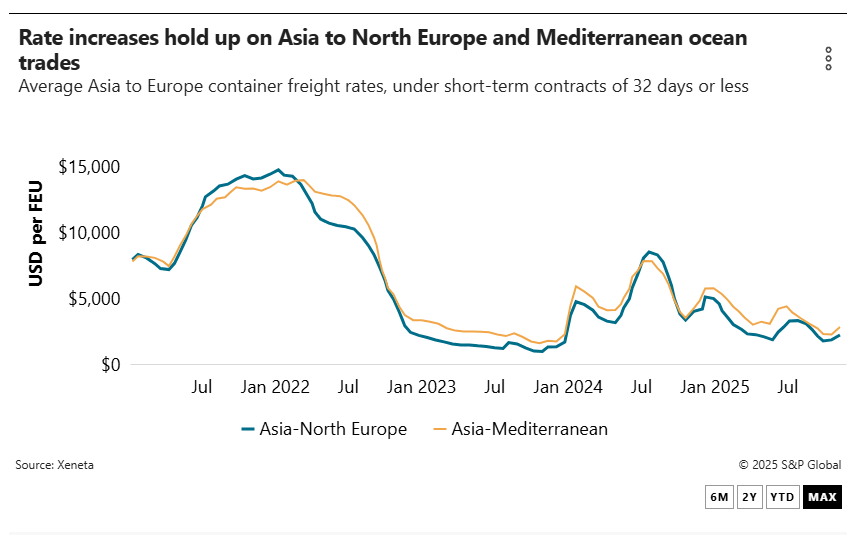

The picture on Asia-Europe is not as gloomy as the trans-Pacific — at least not yet — with carriers on trade lanes to North Europe and the Mediterranean managing to cling to some of the rate increases that have been levied on the market every two weeks since early October.

Short-term rates are up more than 20% since Oct. 1 at $2,349/FEU as of Monday, according to Xeneta, and have held on to gains through November as carriers blank sailings to better match capacity with demand.

Stefan Verberckmoes, senior shipping analyst at Alphaliner, said the rate increases were more successful on Asia-Europe than on the trans-Pacific because of carriers renegotiating contracts between Asia and Europe.

“Carriers are putting more effort into keeping spot freight rates up there as it affects talks with beneficial cargo owners [while] annual contract negotiations on the trans-Pacific are for next year with many contracts starting again in May,” Verberckmoes told the Journal of Commerce.

Blank sailings are a popular tool in the carriers’ capacity management bag and are being used to good effect on Asia-Europe. Carriers have announced November blanks of almost 110,000 TEUs of capacity, with blank sailings already at 83,000 TEUs for December, according to Xeneta’s eeSea data. Both of those numbers are expected to increase.