Time:2025-11-25 Popularity:196

The end of year in ocean shipping in the US is generally lackluster given that most retailers have already brought their goods into the country and still have a month or two early in the new year to restock. But this end to 2025 and start of 2026 is looking more than just lackluster; it’s a deepening slowdown with no end in sight.

The weaker inbound volumes are being felt by transport providers from drayage operators to ocean carriers trying to keep a floor on subdued container spot rates. For at least a year, US importers have been frontloading imports out of fear of higher tariffs, and as American consumers become more cautious, they’re replenishing judiciously.

US retailers are forecasting double-digit percentage declines in November and December, and monthly volumes are not expected to exceed 2 million TEUs through March, according to the latest Global Port Tracker (GPT), produced by Hackett Associates and the National Retail Federation (NRF). Months of frontloading explain the harsher-than-usual import slowdown in the final months of this year, but uncertain consumer sentiment and ever-changing US tariff policy are keeping retail inventories running lean.

“These conditions make market forecasting highly uncertain,” said Ben Hackett, the consultancy’s founder. “Our trade outlook is for a small decline in imports this year compared with 2024 and a further, larger decline in the first quarter of 2026.”

US container volumes in 2026 will be flat to down 2% year over year, according to Moody’s Ratings. Comparably, volumes are to end this year in the range of no growth to an up to 1% retraction compared with 2024, the ratings agency stated in a research note released Tuesday.

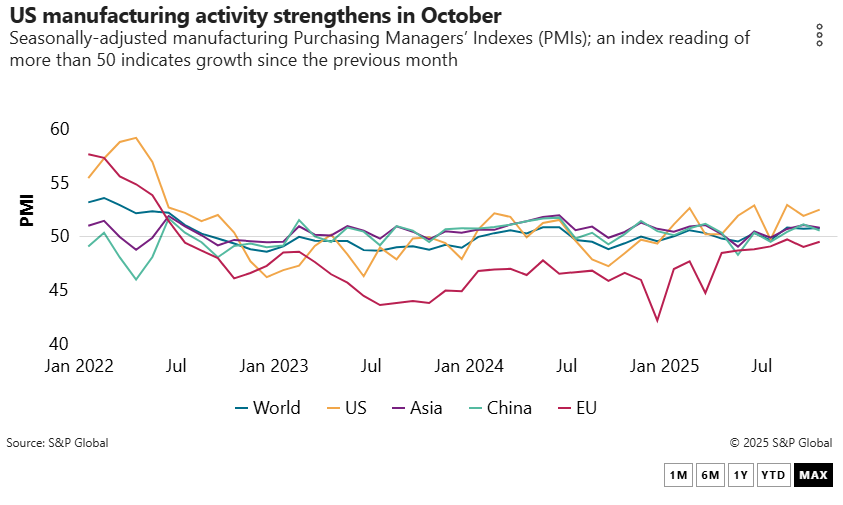

Winter holiday sales are anticipated to grow 3.2% this year, a notably slower pace than the 4.8% expansion recorded last year, according to S&P Global. That slowdown comes as consumer prices rise and job gains slow, with unemployment rising from 4.3% in August to 4.4% in September, according to the Bureau of Labor Statistics. But the US economy keeps expanding, with manufacturing activity growing in October to a reading of 52.2 from 52.5 in the prior month as assessed by S&P Global Market Intelligence’s US Manufacturing Purchasing Managers’ Index.

“Critically, this downshift in [retail] growth is an untimely reminder of consumers’ precarious position; they have managed to continue spending despite the ebb and flow of prices in recent years, but each time their steps have been more measured,” said Michael Zdinak, who leads US consumer markets services at S&P Global.

The US consumer price index (CPI) in September expanded 0.3% on a seasonally adjusted basis, with annual inflation at 3%, reflecting “modest price pressures continuing to affect household budget,” according to the CPI report. The 43-day US federal government shutdown delayed the October release of the US CPI and contributed to the University of Michigan’s consumer sentiment index falling for the second straight month — and to its lowest reading since May — in November.

Retailers have noted the change in consumers. Home Depot, for example, cited concerns over affordability and jobs, lowering its outlook for the rest of its fiscal 2025 year, which ends in January.

“The economic uncertainty continues, largely now due to living costs,” Ted Decker, the chair, president and CEO of the home improvement retailer, said during a Nov. 18 third-quarter earnings call. “Affordability is a word that’s being used a lot. Layoffs, increased job concerns, etc. So that’s why we don’t see an uptick in that underlying storm-adjusted demand in the business.”

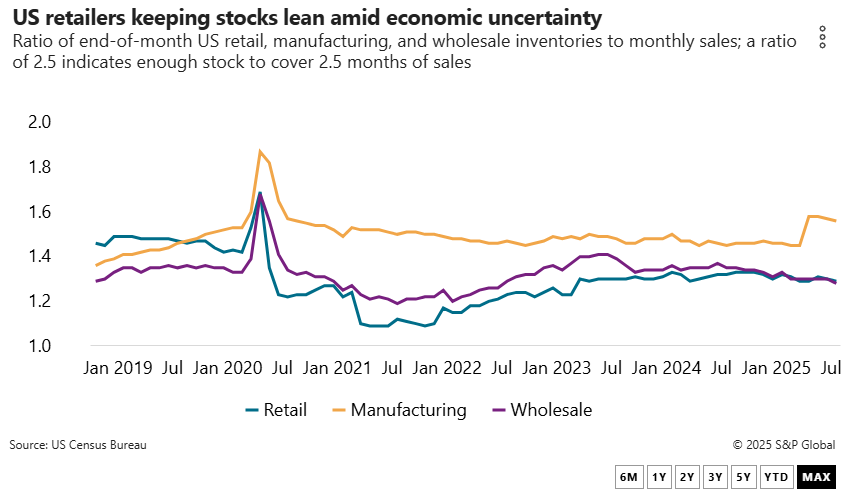

It’s not surprising then that retailers are making sure they have just enough product on hand. US inventory-to-retail sales ratios for retailers have hovered between 1.28 and 1.32, according to the US Bureau of Economic Analysis, suggesting that despite the frontloading of imports in the first half of the year, stocks remain lean. Retailers appear to be extending that strategy into the new year; the GPT report forecasts imports will fall 12.2% year over year to 5.62 million TEUs in the first quarter of 2026.

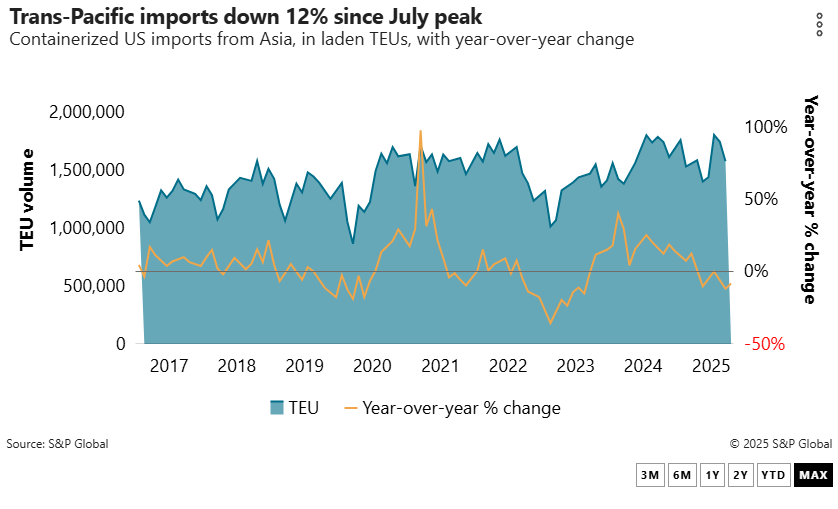

Laden US imports this year peaked in July at 2.6 million TEUs, before sliding 4.6% year over year between August and October, according to PIERS, a sister product of the Journal of Commerce within S&P Global.

But it’s volumes from Asia that have seen the worst of the drop-off, with inbound shipments, including those from India, falling 5.6% in August–October, according to PIERS. Facing a US tariff rate of approximately 47%, laden imports from China plunged 16.7% year over year in the same three-month period.

The weakening Asia trade as of mid-November had dragged so-called bullet rates — prices quoted for specific voyages — from Asia to the US West Coast to below $1,400 per FEU. Spot rates to the West Coast, as measured by various indexes, are down 30% to 60% year over year, depending on the index and trade lane.

Ocean carriers’ biweekly attempts to impose general rate increases have failed, lifting pricing for a just few days before they continue their descent. In 10 of 12 weeks from the end of July through mid-October, trans-Pacific spot rates even fell below the average long-term service contract rate of approximately $1,600 per FEU, according to rate benchmarking firm Xeneta.

“Prices, again, are just in a bit of a freefall,” Sanjay Tejwani, CEO of consulting firm 365 Logistics, told the Journal of Commerce. Ocean carriers “have done what they can,” using blank sailings and shifting vessels between trades to try to match demand, “but it’s too little, too late.”

Yet, there hasn’t been a notable scramble among cargo owners to reopen service contracts, which typically expire at the end of April. Forwarders have also been increasingly blending spot and contract rates for cargo owners to find a better medium for the market to offer customers.

“We’ve not seen any big movements on contracts being open now, since the contracts have been trending down during Q3, and it was not very timely for people to do when they know they have the negotiation coming soon and as long as things are moving their way,” Maersk CEO Vincent Clerc said during the company’s third-quarter earnings call Nov. 6, adding that customers have generally been meeting their allocated contract volumes.

Despite the lower spot rates and weaker outlook, container lines haven’t pulled out services and have blanked capacity at levels similar to past years. In fact, ocean carriers plan to add more capacity from Asia to the US in December, according to maritime intelligence provider eeSea.