Time:2025-09-03 Popularity:328

Container lines, facing rate pressure on all major trades, are doubling down on cutting costs that have materially increased above pre-pandemic levels.

Executives from Hapag-Lloyd, Maersk and Zim Integrated Shipping Services told investors during second-quarter earnings calls that they are facing higher prices from shipbuilding to port labor. And that has prompted cost-cutting measures ranging from improving fuel efficiency through better scheduling, cutting port time, returning chartered ships at the end of contracts and slow steaming.

“Pre-COVID we were bunkering the ships on HFO [heavy fuel oil], and since then we have transitioned to VLSFO [very low-sulfur fuel oil]. This is a cost increase,” Zim CFO Xavier Destriau told analysts. “If we look at the newbuilding price, that went up. The chartering rate went up. So the cost of securing tonnage has also gone up compared to the prior period.”

Destriau also pointed to increases in cargo handling charges, higher wages for dockworkers that are passed on to carriers, and a lack of terminal investment that has made port congestion an ongoing challenge requiring more ships per string.

“To give you an example, our main Asia to the US East Coast service used to operate on a weekly basis with 10 ships pre-COVID, but now we need 12 in order to maintain the weekly schedule,” he said.

“All these elements of additional cost have found their way into our cost structure, and that contributes to increasing the overall cost that we carry,” Destriau added.

While carriers believe higher rates at the end of the second quarter and strong bookings through July will ensure third-quarter earnings are close to those recorded in the second quarter, the shipping companies are expecting a fourth-quarter decline and thus are intensifying cost-reduction efforts across their networks to mitigate any supply-demand shortfall.

Steady rise in capacity

Global demand has been resilient year to date, but J.P. Morgan in a market update Tuesday pointed to softening trends in the second half. The bank highlighted overall first-half ocean volume growth of 4.5% year over year, while real global GDP grew 3% in the same period.

“We expect market growth to slow in the second half and forecast 1.8% in Q3 and flat in Q4 [-0.3%],” the bank noted. “For 2026 onwards, we estimate volume growth of 2% per annum, broadly in line with J.P. Morgan economists’ real GDP growth forecasts, as we expect the trade multiplier to hold at 1x.”

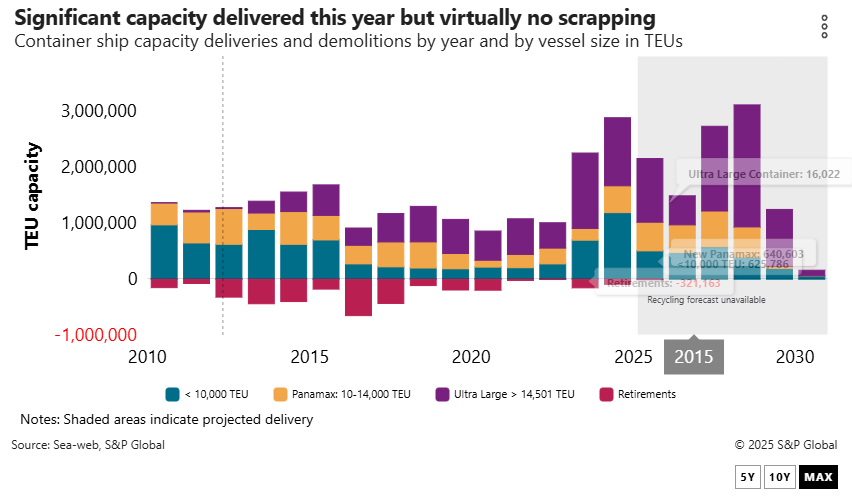

J.P. Morgan is expecting the rate erosion to accelerate over the next two years as demand slows and capacity grows, pushing the industry into deep losses.

“We expect a widening demand-supply imbalance into H2 25, driven by slower demand growth into the end of the year and estimated effective supply growth of 6.5% year over year,” the bank noted.

A return of sailings to the Red Sea in 2026 will drive supply growth up 9%, but even if the route remains closed, effective supply will still grow 3% to 5%, the market update predicted.

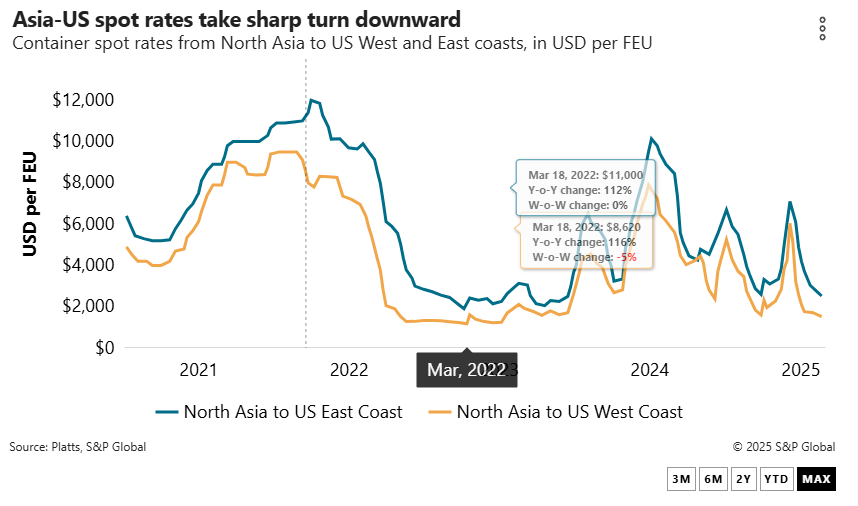

Spot rates are certainly feeling the effects of weakening demand and excess capacity. Asia-US West Coast spot rates at $1,640 per FEU are one-third of the price at the beginning of January, according to Platts, a sister company of the Journal of Commerce within S&P Global. On Asia-North Europe routes, rates are half of what they were on Jan. 1, while on the trans-Atlantic westbound trade, spot prices have been at loss-making levels for weeks.

At the same time, capacity is steadily increasing. The global order book is now 9.3 million TEUs, or 29% of the in-service fleet, according to Alphaliner. About 1.8 million TEUs of capacity are set to be delivered this year, with another 1.6 million TEUs coming online in 2026, according to Drewry.

Still, Hapag-Lloyd CEO Rolf Habben Jansen told analysts on the carrier’s recent second-quarter earnings call that while rates were falling on the major trade lanes, he could not imagine any scenario where they would remain 10% to 20% below unit cost levels for a sustained period due to underlying supportive fundamentals.

“Anyone who believes that freight rates would go back to that level, it’s just not going to happen because we see EU ETS [Emissions Trading System], we see low-sulfur fuel, we see the prices of shipyards having gone up significantly on investments that need to be done for newer ships,” he said, adding that port congestion means boxes and ships take longer to turn.

In an aggressive move to bring down expenses in a rapidly eroding rate environment, Hapag-Lloyd recently launched a comprehensive cost-cutting program that targets more than $1 billion in savings by the end of 2026, with the program extending across the carrier’s network and including synergies and efficiency gains from its Gemini Corporation alliance with Maersk.

“We set ourselves a target to bring unit costs down in a double-digit percentage versus what we saw in 2022 ... I think that is achievable,” Habben Jansen said. “I also believe the $1 billion plus [cost-cutting target] is realistic to get that out until the end of next year.”

No return to 2019 rate levels

Habben Jansen said even with the extensive cuts in expenses, it would not bring the carrier costs back to 2019 levels “for the very simple reason that some of our factor costs are very different.”

“We did not have the EU ETS before COVID, and we did not have low-sulfur fuel. Those alone will drive up costs quite significantly,” he said. “Then there has been inflation that impacts our cost as well, and you certainly cannot negotiate that away.”

Unit costs at Hapag-Lloyd rose 4% in the first half year over year to $1,320 per TEU, up more than $300 per TEU compared with pre-pandemic times. However, a significant portion of the increased expenses were generated by the startup investments required in the transition of Hapag-Lloyd’s services to the new Gemini Cooperation network.

While Gemini’s startup expenses were adding to the costs of its members, Maersk CEO Vincent Clerc outlined the cost savings that will be generated by the new network with “two principal buckets” set to drive down unit costs.

“One is the reliability of schedules that means lower fuel consumption,” Clerc said during the carrier’s recent second-quarter earnings call with analysts. “The second one is less sail distances also means higher asset intensity where we can basically move more cargo on the same amount of tonnage, which lowers the unit cost as well.”

Clerc said cost increases in the charter markets and at marine terminals battling congestion were being exacerbated by ongoing diversions around southern Africa to avoid attacks on commercial shipping in the Red Sea.

“We saw further inflation in the cost base because of the longer sailing distances that we have, which means that our breakeven point is higher now than it was in 2019,” he said, although he did not disclose Maersk’s rate breakeven point.