Time:2025-08-28 Popularity:386

Rates on the trans-Atlantic westbound ocean trade — a route dominated by Gemini Cooperation and Mediterranean Shipping Co. — have been stuck at loss-making levels for weeks, yet carriers are showing little appetite for blank sailings to raise prices.

Spot rates assessed by Platts, a sister company of the Journal of Commerce, are at $1,600 per FEU this week, far below the breakeven level ocean carriers say is near $2,100/FEU. Rates have lost only $100 since mid-May.

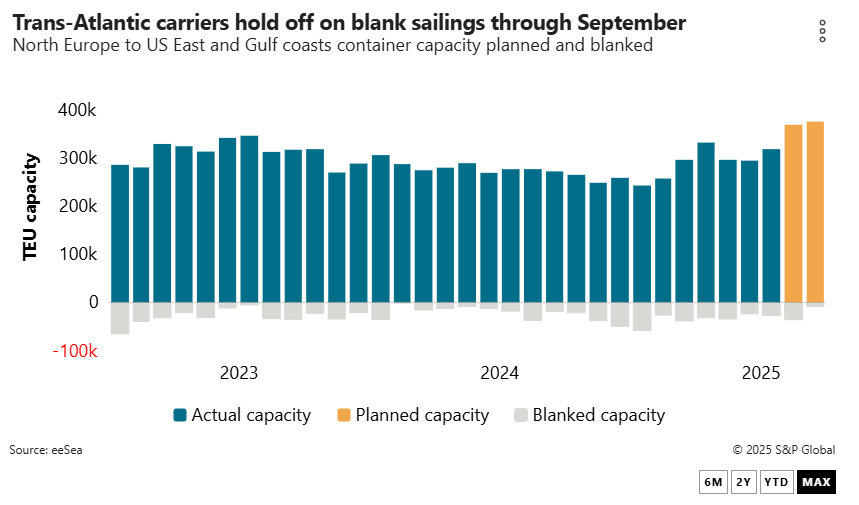

While carriers on the North Europe-US East Coast route are scheduled to increase deployed capacity to 376,132 TEUs in September, up 2% compared with August, just 7,349 TEUs in capacity will be withdrawn via blank sailings, according to data from rate benchmarking platform Xeneta.

However, Destine Ozuygur, product marketing manager for Xeneta, cautioned about reading too much into the low blank sailings levels.

“Blanks used to be a standard measure against persistent demand deficit, but it’s also become a widely used tool for ad-hoc reliability management,” Ozuygur said. “Carriers are far more comfortable admitting them into schedules in the short term, and repealing them, than they used to be.

“Regardless of the tariff or rate environment, we would naturally expect at least a few more blanks to trickle in over the coming weeks,” she added.

The restructured ocean alliances have adjusted market share on the trans-Atlantic, leaving the trade lane dominated by MSC and Gemini partners Maersk and Hapag-Lloyd.

Data from Alphaliner shows that after splitting from its 2M partner Maersk, MSC increased its Atlantic market share from 41.1% to 41.8% over the 12 months from July 2024 to July 2025. MSC now deploys a fleet of more than 500,000 TEUs between Europe and North America.

Hapag-Lloyd remains the second-largest carrier in the trade, but its market share of 14.9% is significantly lower than the 19.6% share it held in July 2024. Hapag-Lloyd’s Gemini-partner Maersk increased its market share from 8.9% in July last year to 14.4% this year.

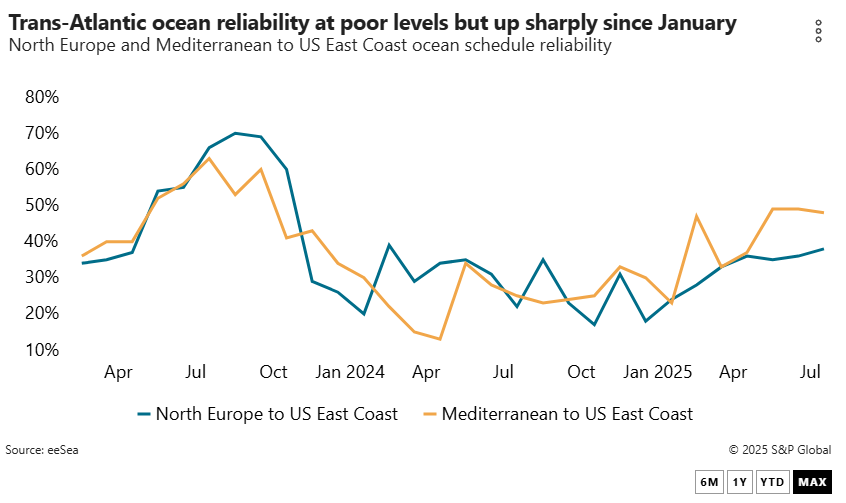

“With the absence of both Ocean Alliance and Premier Alliance on this trade, reliability is largely left to Gemini, MSC and the non-alliances services,” said Ozuygur.

Despite a lack of wider carrier representation, the present incumbents are not exactly setting reliability records. North Europe to US East Coast schedule reliability in July was 38%, a dismal level by any measure, although still a significant improvement on January’s 24%, Xeneta data showed.

Some of the blame can be attributed to ongoing European port congestion that slows vessel turnarounds, which, on the relatively short transits across the Atlantic, “adds another layer of constraint and reduces effective service frequency,” C.H. Robinson noted in a recent market update.

The schedule reliability and capacity deployed through the rest of the year will likely depend on how demand shapes up in the new trans-Atlantic tariff landscape.

In a July 27 deal, a 15% tariff was applied to most EU goods exported to the US instead of the 30% tariff President Donald Trump had previously threatened, averting a destructive trade war. The deal included provisions for zero tariffs on certain US exports to the EU and left the door open for negotiations on further market access.

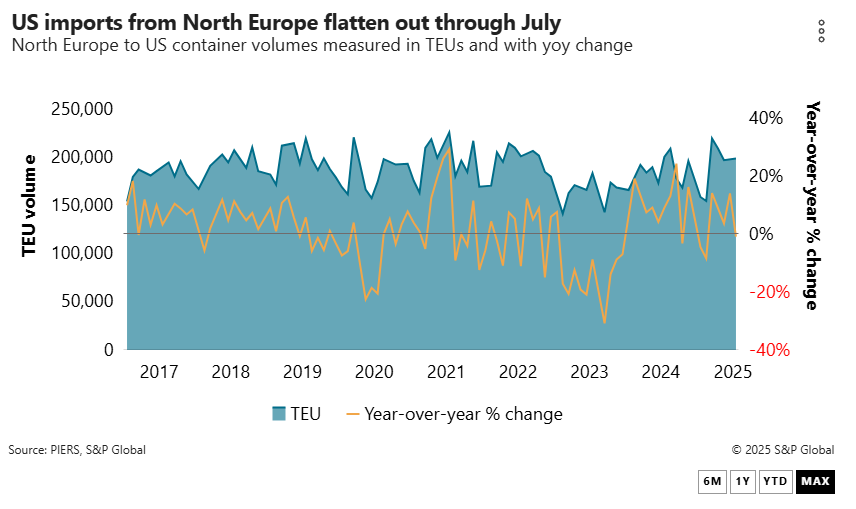

Frontloading in June as US-EU trade tensions escalated saw North Europe to US East Coast volume grow 14.2% year over year to almost 200,000 TEUs, according to PIERS, a sister product of the Journal of Commerce within S&P Global. It was short-lived, however, with July volume sliding to 198,750 TEUs.

Most observers believe the 15% tariff, while significantly higher than the pre-deal tariffs of about 4.8%, is not high enough to create a material change in shipper behavior on the trans-Atlantic.

But Emily Stausbøll, senior analyst at Xeneta, said while 15% was more manageable than the threatened 30%, it was expected to keep demand muted considering frontloading in the second quarter has left fewer goods needing to be moved over the rest of the year.

“We are still in a waiting period before we see the real effects of tariffs on prices and US consumer demand, with frontloading and retailers absorbing some of these extra costs,” Stausbøll told the Journal of Commerce. “But at some point, this will be passed on and should lower demand on this trade over the longer term.”

The “wait-and-see” approach was also highlighted by an executive from one of the ocean carriers on the trans-Atlantic who said the market did not seem to have been heavily affected by the tariffs.

“There have been clients taking a wait-and-see approach and others adding some shipments, but that is not having a major impact on the trade route, partly due to tariffs not being high enough to affect trade flows,” the carrier executive said, adding that the trade lane was expected to “settle without much change.”

Xeneta’s Ozuygur agreed that shippers were taking a wait-and-see approach, noting that after the trade agreement, the trans-Atlantic was on a more stable and positive footing than during the volatile buildup to the deal.